Blog #2 “Could a New, Islamic Approach to Banking Change the World? ”

2021.05.19

Category: Blog

Author: Shinsuke Nagaoka

“I’ll come over there now. Let’s think this through together.”

A stoutly-built lending manager across the desk from me replied into the phone as I was conducting an interview at a bank in Dubai, UAE. Apparently, he was speaking to a businessman who had borrowed money to sell Arab folk crafts, but was calling to ask for more time to repay the loan because sales were not so good. The manager cut short my questions and headed to the businessman’s shop. With the bank’s permission, I accompanied him.

Upon arrival, the manager pelted the shop-owner with a rapid-fire series of questions and comments: “How much are you selling, where, and for what price?” “You can’t sell that way!” “You have to stock more of these products!” Without asking, the lending manager rearranged the layout of the folk crafts on display, and called the shop’s suppliers himself to order some more items. I stood there stunned as the business owner beside me nonchalantly assisted the manager, occasionally offering up opinions.

As the questions and answers drew to a close, the manager declared, “This will improve sales next month! See you again!” He exited the shop and stepped into his car. “You didn’t mention repaying the loan?”, I objected. With little sign of concern, he replied, “His sales this month were terrible. But I didn’t talk about repayment today, because I expect he’ll do very well next month. If he turns a profit, he can pay us back. And that’s better for our bank.”

Curious about the outcome, I revisited the bank the following month to speak with the manager again. He appeared, greeting me with a broad smile, reporting, “After that, sales at the shop improved sharply. Just like I said, right? And our bank also made a lot of money.”

People familiar with the lending policies of conventional banks might have some questions about this: “Isn’t the bank manager interfering too much with the shop’s business?” “If it’s time to repay the money, why doesn’t the bank simply say it’s time to repay the money?” “If sales improve at the shop, then does the bank also make more money?”

According to the banking system as we know it, once the bank lends the money, it is up to the borrower to decide how to use it. And, once repayment time comes, you have to repay the bank the amount of the loan plus interest, even if you’re undergoing a financial hardship. Also, the borrower is not obligated to pay additional money to the bank if the business does particularly well. So, the bank doesn’t share in the profit from the business’s success.

The style of lending and borrowing money that I witnessed in Dubai is something completely different from what we take for granted. Indeed, banks adopting this new approach are appearing one after another across the Islamic world. The first such bank was established in Dubai.

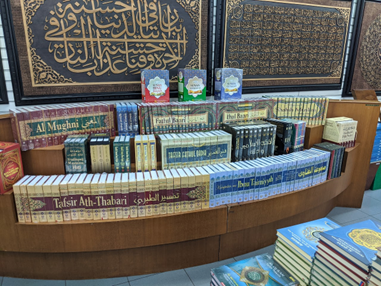

This new hands-on approach is called “Islamic Banking” because it lends and borrows money according to the tenets of Islamic religious teachings. Islamic teaching disavows the idea of lending out money and then simply waiting to be repaid with interest. Instead, it is taught, a lender should actively work with a borrower to ensure their success. And if a borrower’s business is successful, the bank is entitled to a share of the profits. Conversely, if the borrower’s business fails, the bank assumes partial responsibility and cannot require the money to be repaid.

You can see how the interaction between the Dubai lending manager and the shop-owner described above embodies these Islamic teachings. The lending manager was intervening in the owner’s business so that the money would be properly repaid and the bank could make more money. And from the shop-owner’s perspective, a bank that will personally consult with them to improve their business seems very dependable.

This shows how, in Islamic banking, lenders and borrowers work hand-in-hand, similar to investment partners. Moreover, this includes the people who deposit the money that the banks then lend out. At Islamic banks, these ordinary depositors are also required to regularly check on whether the bank is lending their money to appropriate borrowers. In that sense, the general public is also a kind of business partner.

The capitalist economy we live in has many problems. One of which is a lack of sense of responsibility toward money. We entrust our money to the banks, but don’t concern ourselves with to whom they lend that money, and for what purpose. We tend to choose where to deposit our money thinking mainly of short-term profits. And then we somehow receive interest commensurate with our deposits. Meanwhile, the borrowers rarely wonder from whom the money they are borrowing originally came. As a consequence, we’ve repeatedly seen cases where people run their business recklessly or use the money for unintended purposes, sometimes negatively impacting the economy as a whole.

Most people are familiar with the words “financial crisis”. The 2007 global financial crisis caused unprecedented damage throughout the world’s economy. Financial crises like these result from people taking advantage of an economic system in which anonymous irresponsible lenders and borrowers have come to use money however they please.

Islamic banking takes a very different approach to lending. In this system, the lender and borrower can see one another’s faces, and make use of the money based on mutual trust. In the wake of the global financial crisis, people around the world fearing a “faceless” banking system are increasingly looking to Islamic banking as a potentially suitable approach.

Islamic banks are not restricted to Muslims. Anyone who agrees to their policies and principles can use them. So, if this hands-on approach to banking makes sense to you, you can avail yourself of it. In fact, there is a global movement to recreate the “face to face” approach of Islamic banking to address our modern financial problems.

In this sense, I believe the wisdom of Islamic banking has the power to transcend the Muslim/non-Muslim divide. And that wisdom is actually lurking everywhere in Islamic thinking.

The Muslim population will continue to grow over the next century. Every society will not be able to live separate from Islam. Surely, to create a bright future for a Muslim-inclusive global society, we will need to uncover such Islamic wisdom and share it with all of humankind. The global spread of a new banking system coming from Islamic teachings may be a first step in that direction.