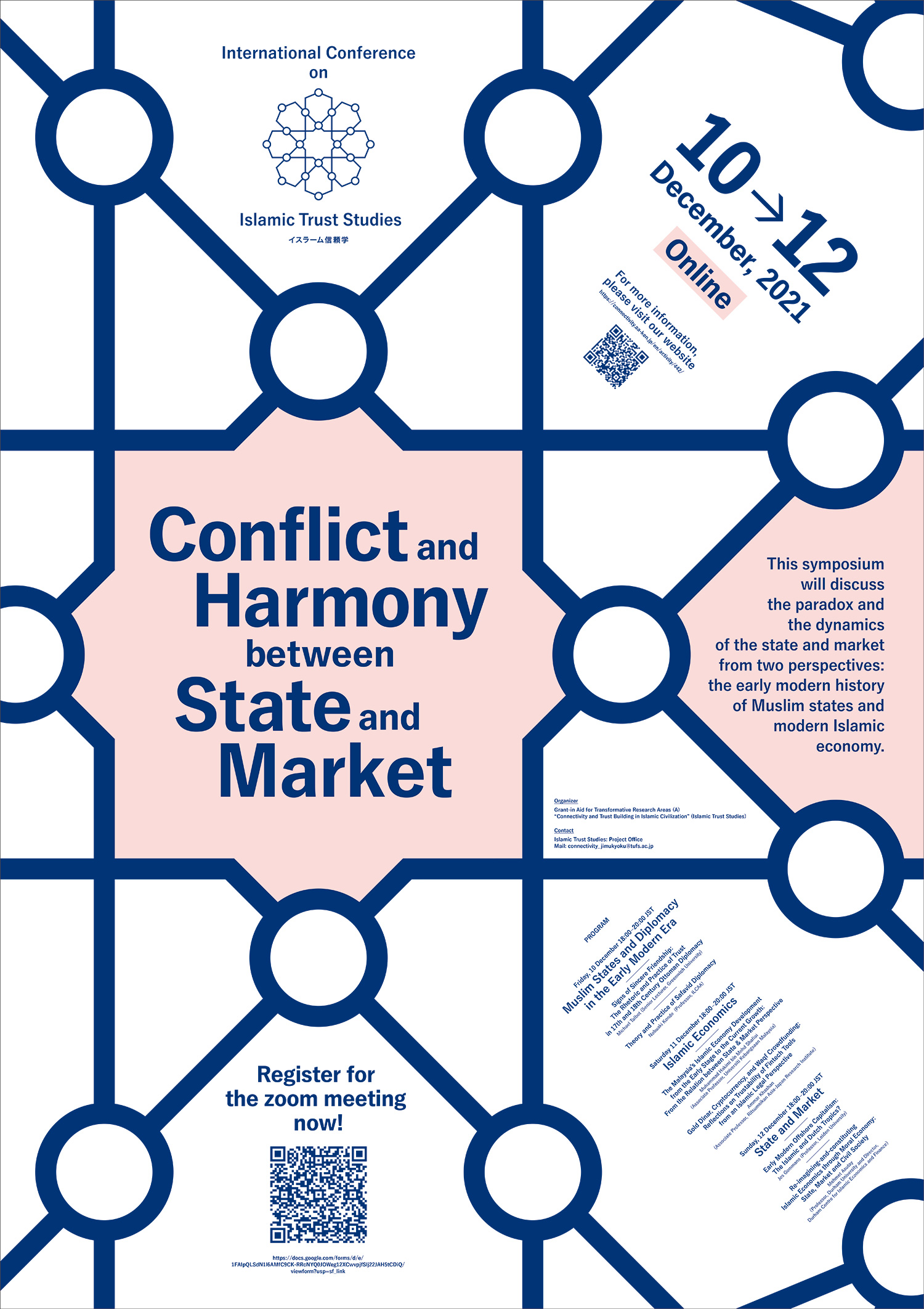

Finished International Conference on Islamic Trust Studies: Conflict and Harmony between State and Market (Dec. 10–12)

2021.11.17

Category: Symposium

Research Group: B01 State SystemsA01 Islamic Economy

The International Conference “Conflict and Harmony between State and Market” will be jointly organized by group A01 (Mobility and Universality in the Islamic Economy) and group B01 (The Ideas of the Muslim Community and State Systems) of the Islamic Trust Studies Project.

Islamic Trust Studies Symposium 2021 Program and Abstracts PDF

Objectives of the Symposium

This is the joint conference of group A01 (Mobility and Universality in the Islamic Economy) and group B01 (The Ideas of the Muslim Community and State Systems) of the Islamic Trust Studies Project. The market plays a vital role in Islamic civilization. Even in the doctrine of Islam as a religion, one can find expressions related to trade and the market. In other words, trade and the market are essential parts of Islamic connectivity. Although the state has a hierarchical structure in general, it has its own network of diplomacy, and trust is the most significant element for maintaining the network.

Considering the relationship between the state and market, one can easily discern conflicts and harmony. The state occasionally attempts to confine a commercial network within its framework, intervene in, or control the market, despite the fact the market’s economic success, which is crucial to the state, is often dependent on free economic activity rather than on state control.

This symposium will discuss this paradox and the dynamics of the state and market from two perspectives: the early modern history of Muslim states and modern Islamic economy. The first day will focus on the early modern states and mutual relations between them as diplomacy when the West had yet to achieve political and economic hegemony in the world. The second day will focus on the relationship between the state and market in the modern Islamic economy, with a discussion on Malaysia and the digital economy. On the final day, a comprehensive discussion will be held from both perspectives (early modern history and modern Islamic economy).

Program

Friday, 10 December 18:00–20:00

Opening Address by Area Organizer for Islamic Trust Studies, Hidemitsu Kuroki (Professor, ILCAA, Tokyo University of Foreign Studies/ Slavic-Eurasian Research Center, Hokkaido University)

Introduction by Nobuaki Kondo (Professor, ILCAA)

Muslim States and Diplomacy in the Early Modern Era

Moderator: Jun Akiba (Professor, The University of Tokyo)

-

Michael Talbot (Senior Lecturer, Greenwich University)

“Signs of Sincere Friendship: The Rhetoric and Practice of Trust in 17th and 18th Century Ottoman Diplomacy”

One of the key concepts in Ottoman diplomacy practice was dostluk, ‘friendship’. Ottoman commercial treaties and diplomatic memoranda are filled with words and phrases describing different forms of friendship and affection, a primary condition for the establishment and continuance of international relations. Such documents also set out the ways in which such friendship might be proved and maintained through specific diplomatic practices that would demonstrate a continued and sustained effort to demonstrate trust. This paper will examine some of these terms from the context of Ottoman diplomatic relations with Britain in the seventeenth and eighteenth centuries. It will initially outline and explore the basic vocabulary and expected practices that would enable political and commercial trust to be established in diplomatic relations. It will then look at the rhetoric in action, especially in cases when the Ottomans expressed the view that trust had been tested or broken by the British themselves, and when the Ottoman state attempted to justify its own foreign policy actions using the tropes of friendship and trust within a clear legal setting.

-

Nobuaki Kondo

“Theory and Practice of Safavid Diplomacy”

Diplomacy is the most significant factor for discussing trust and connectivity among the early modern Islamicate states. Various studies have been undertaken on diplomatic relations between the Safavids and other dynasties; however, their diplomacy theory and practice remain unexamined. This paper explored their diplomatic perspective and how this perspective differed from the reality.

The fiqh works, such as Shaykh Bahāʾī’s Jāmiʿ-i ʿAbbāsī, will be examined. Although researchers have examined the siyar (the Hanafi “international” law), Shiʿi/Jaʿfarī international law has been neglected. The regulations are included in the chapter of Jihād in the fiqh works and directly relate to war and peace of the Safavid state.

Moreover, an akhlāq work and a mirror for princes from the Safavid period were investigated. Although these works have been discussed in relation to political thought, anything concerning diplomacy has not been explored. These works explain how the ruler should allocate diplomatic envoys and the subsequent nature of their mission. These works provide practical diplomatic norms, and their contents were compared with the actual practices understood through the Safavid chronicles.

Saturday, 11 December 18:00–20:00

Islamic Economics

Moderator: Shinsuke Nagaoka (Professor, Kyoto University)

-

Muhammad Hakimi bin Mohd Shafiai (Associate Professor, Universiti Kebangsaan Malaysia)

“The Malaysia’s Islamic Economy Development from the Early Stage to the Current Growth: From the Relation between State & Market Perspective”

Islamic economic practices in Malaysia have undergone rapid development in the recent 30 years. The Islamic economy development in Malaysia encompasses three main segments, namely piety (ibadah)(Tabung Haji), profit-making (Islamic banking & finance and halal industries), and Islamic social finance (zakah, waqf, and sadaqah). The progress of all these segments can be seen through several indicators, namely in terms of institutional establishment, total asset holdings, the existence of a special legal framework, and integration with current technologies. Thus, this presentation aims to discuss the narrative of the Islamic economy development in Malaysia from the early stage to the current growth; particularly, from the perspective of the relation between state and market. According to Stiglitz, the state and market can be complementary; both engage in the same sector but with different roles. The discussion’s finding simply a harmonious relationship between state and market in Malaysia’s Islamic economic development context. This situation has supported the rapid growth of Islamic economic practices in Malaysia. The Islamic economy development in Malaysia should always be synergised between state and market, especially in current policies, industrial needs, technologies, and others, to move forward. It is towards achieving maqasid syariah economy, primarily in empowering the economy of ummah inclusively, including promoting economic inclusion and inclusive growth agendas.

-

Ammar Khashan (Associate Professor, Ritsumeikan Asia-Japan Research Institute)

“Gold Dinar, Cryptocurrency, and Waqf Crowdfunding: Reflections on Trustability of Fintech Tools from an Islamic Legal Perspective”

The implications of FinTech innovation in the Islamic context have been frequently discussed and there have been in-depth arguments among Islamic legal and finance specialists. One of the most argued issues in this context is the recent one concerning cryptocurrency and its based technology blockchain, which bypass the intermediary conventional bank and rely on a peer-to-peer (P2P) system which is open to anyone to make a transaction by instant payment or receipt. Since 2018, when bitcoin for instance crashed in the Gulf countries, and increasingly in 2021 with the successive setbacks and losses in the case of bitcoin and the rise of other cryptocurrencies such as Ethereum, questions about the trustability of cryptocurrency in general and its legitimacy as a currency from the Islamic legal perspective have increased and accordingly fatwas forbidding it have also increased.

On the other hand, going back to the 2010 launching the golden dinar in Kelantan, Malaysia and even the call to return to gold and silver as a currency for Islamic countries reveals the other side of the equation when cryptocurrency issues are argued from Islamic perspective. Namely, the historical ongoing argument about the nature of money itself in the Islamic law.

Between these two directions of the traditional usage of real gold and silver currencies and the invention of digital cryptocurrencies, lays the utilizing and adopting of FinTech Islamically through a merger between them called “waqf crowdfunding”. Ithas been launched in recent years, and I have been conducting research on this new innovation.The Islamic legal arguments have not yet manifested in the case of waqf crowdfunding because of the traditional waqf’s obvious connection to the real economy and its welfare objectives. However,“crowdfunding” apparently employs fintech tools. It is an important step forward in the application of digital fintech technology in the Islamic welfare institutions, therefore, it may eventually lead to a reversing of the opinionson cryptocurrencies in the final analysis.

This presentation will shed some light on the previously mentioned elements of Islamic FinTech and their trustablity in the light of current Islamic legal discussions on digitalizing Islamic welfare institutions by introducing the related legal and financial arguments and their principles and approaches underlying such arguments.

Sunday, 12 December 18:00–20:00

State and Market

Moderator: Nobuaki Kondo

-

Jos Gommans (Professor, Leiden University)

“Early Modern Offshore Capitalism: The Islamic and Dutch Tropics?”

This paper starts with a discussion of the contemporary phenomenon of “offshore capitalism”, also called “archipelago capitalism”. In a recent article by Vanessa Ogle in the American Historical Review (2017) such an archipelago particularly refers to tax havens: places with sufficient autonomy to allow individuals and corporations to register and maintain assets there while paying low taxes, avoiding stringent regulations, instead offering secrecy and anonymity as well as eased incorporation and registration procedures. Indeed, all these describe ways for capital to flee the regulations of the state. In my paper, however, I will explore the validity of this contemporary phenomenon for the pre-modern Indian Ocean world. As two possible cases in point, I will explore more in particular the spread of Islam and the establishment of the Dutch East Indian Company in the Southeast Asian Tropics.

-

Mehmet Asutay (Professor, Durham University and Director, Durham Centre for Islamic Economics and Finance)

“Re-imagining-and-re-constituting Islamic Economics through Moral Economy: State, Market and Civil Society”

Islamic economics movement, in modern times, emerged in the post-colonial, and, hence, nation-state construction process as a counter-hegemonic discourse to rescue human, land/environment and labour. In its double-movement nature, the Islamic economics movement aimed to constitute the economic and financial realm of the Muslim societies according to the cognitive system of Islam. Therefore, as a post-colonial response, the novelty of the movement towards authenticity was the critical nature of the movement.

Despite the universal claim of Islam, which is the fundamental basis of the Islamic economic movement, the primary barrier for developing it into an applied system has been the ‘nation-state’. This is due to the fact that the nature of the nation-state that emerged in the Muslim world was designed according to the modernity within the Enlightenment definition of what human is and how human is located in the universe regardless of whether these Muslim states have been revolutionary, tribal states or states constituted through Islamic claims. Thus, irrespective of their various claims of legitimacy through Islam, the Muslim nation-states have been modernity shaped states with capitalism (mostly) at the heart of the economic system. Therefore, the central dilemma was transforming the universal that is Islamic into a particular that is the nation-state.

The challenge for Islamic economics posed by the nation-state and its economic structure, namely market, resulted in partial analysis and partial application of Islamic economics through Islamization of the economic sphere to create opportunity space for ‘Islamic’ to exist in the society, economy and polity. Therefore, the Islamic economic movement has to give up its aspiration and accept the hegemony of the existing nation-state through its market system-oriented regulation to carve an opportunity space for Islamic identity in the existing financial system. This has led to the grafting process leading to the current Islamic finance sector within the existing financial system, namely dual banking system with Islamic finance being the hybridity. Thus, the hegemonic nature of the state has not allowed its hegemony to be challenged by the Islamic proposition aiming to shape an alternative economic system based on Islam. In other words, the universality of Islam has to give way to the hegemony of the nation-state and the market.

Some experiment in Islamic economics as a dynamic of civil society, for example, in Indonesia, is important to mention. In this experiment, rather than expecting the nation-state to create the necessary opportunity space for Islamic finance to exist, Indonesian Muslims in the civil society organised in the form of BMT (Baitul Maal wa Tamwil)’s to express their identity in a dynamic nature. However, the Indonesian nation-state has taken up Islamic finance as a policy, which implies that Islamic finance will be subordinated to the state rather than expand within its own organic emergence. The nation-state, thus, has been taken up the Islamic finance to mould it according to its own system and hence relegating its particularities by its hegemony. However, the Islamic system of the economy as aspired by the Islamic economics movement aimed at an Islamic social formation and hence an embedded economy. The consequence has therefore been defined as Shari‘ah compliant Islamic finance as opposed to Islamic based Islamic economy. In this transformation, the hegemonic role of the nation-state plays an essential role by sub-ordinating the Islamic finance within its nature of ‘state’. Thus, movement from Iqtisad to Islamic finance relates to the dominant hegemony of the state and its economic system, namely the market.

An essential aspect of the debate can be related to the actual applications of Islamic economic rules during the time of the Prophet and the Rightly Guided Caliphs. Some contenders in modern times have used that initial experiment to justify the nation-state as an inevitable framework of Islamic economics. However, the state nature of the initial experiment is open to debate, as the operation mechanism of the organisation of that society was far away from the nature of the nation-state and was very close to civil society operation at least until the third caliph (Uthman). Therefore, the state did not have any accumulative power, and Baitul-maal was mainly operating to return society’s right to society due to the inherent value proposition of Islam. The justification of the state, in particular the nation-state, as a benevolent and sacrosanct entity cannot, therefore, be justified nor can be a base for Islamic economics in modern times, as the ontological ground of the contemporary state refers to a particular worldview with its definition of parameters, which is beyond benevolent.

This paper, hence, aims to discuss the emergence of the Islamic economics movement as a search for authenticity between heterodoxy and orthodoxy vis-à-vis state, market and civil society.

Concluding Remarks by Shinsuke Nagaoka

Language: English

Venue: Online meeting via Zoom, Open to public/Admission free, Pre-registration is required.

Pre-registration: Please use the form for pre-registration.

Registration Deadline: Sunday, December 5 at 23:59 (JST).

Co-organizer:

Grant-in-Aid for Transformative Research Areas (A),“Mobility and Universality of Islamic Economy” (Principal Investigator: Shinsuke Nagaoka (Kyoto University); 20H05824)

Grant-in-Aid for Transformative Research Areas (A), “The Ideas of the Muslim Community and State Systems” (Principal Investigator: Nobuaki Kondo (ILCAA); 20H05827)

Contact:

Islamic Trust Studies: Project Office (connectivity_jimukyoku[at]tufs.ac.jp)